What’s happening in the housing market?

JULY MARKET UPDATE

JUNE MARKET UPDATE

FEBRUARY MARKET UPDATE

It’s probably not a shock that the real estate market is softening. After a period of low-interest record rates, we’ve seen a significant increase in the average mortgage after multiple subsequent rate point hikes from the Fed as it tackles inflation. This has hampered both buyers and sellers.

This creates a lock-in effect. Homeowners like you probably hold a low-interest rate mortgage and are reluctant to sell in an environment with rising rates. Buyers also don’t want a high-interest rate, but buyers are still in the market. Mortgage companies offer alternatives to a 30-year fixed loan along with many ways the buyer and seller can work to buy down the loan to make the payments more palatable.

There are fewer listings on the market, and active buyers are still looking for the perfect home at the right price. Some homes are still selling within weeks, about 30% nationally. What’s the secret? Being ready for occupancy and pricing properties based on condition and comparable sales.

An excellent real estate agent can work with you to do the right things to make your home attractive to potential buyers. If you’re not interested in selling right now, you can sit tight because you’ve built equity in your home, and even in this unsteady market, that equity will likely not erode.

I’m always here to answer questions about the property value of your home and specific neighborhood.

NOVEMBER MARKET UPDATE

OCTOBER MARKET UPDATE

SEPTEMBER MARKET UPDATE

WEEK OF SEPTEMBER IN REVIEW

Fed speakers made headlines with hints about their next move on rate hikes. TO READ THE FULL ARTICLE, CLICK HERE....

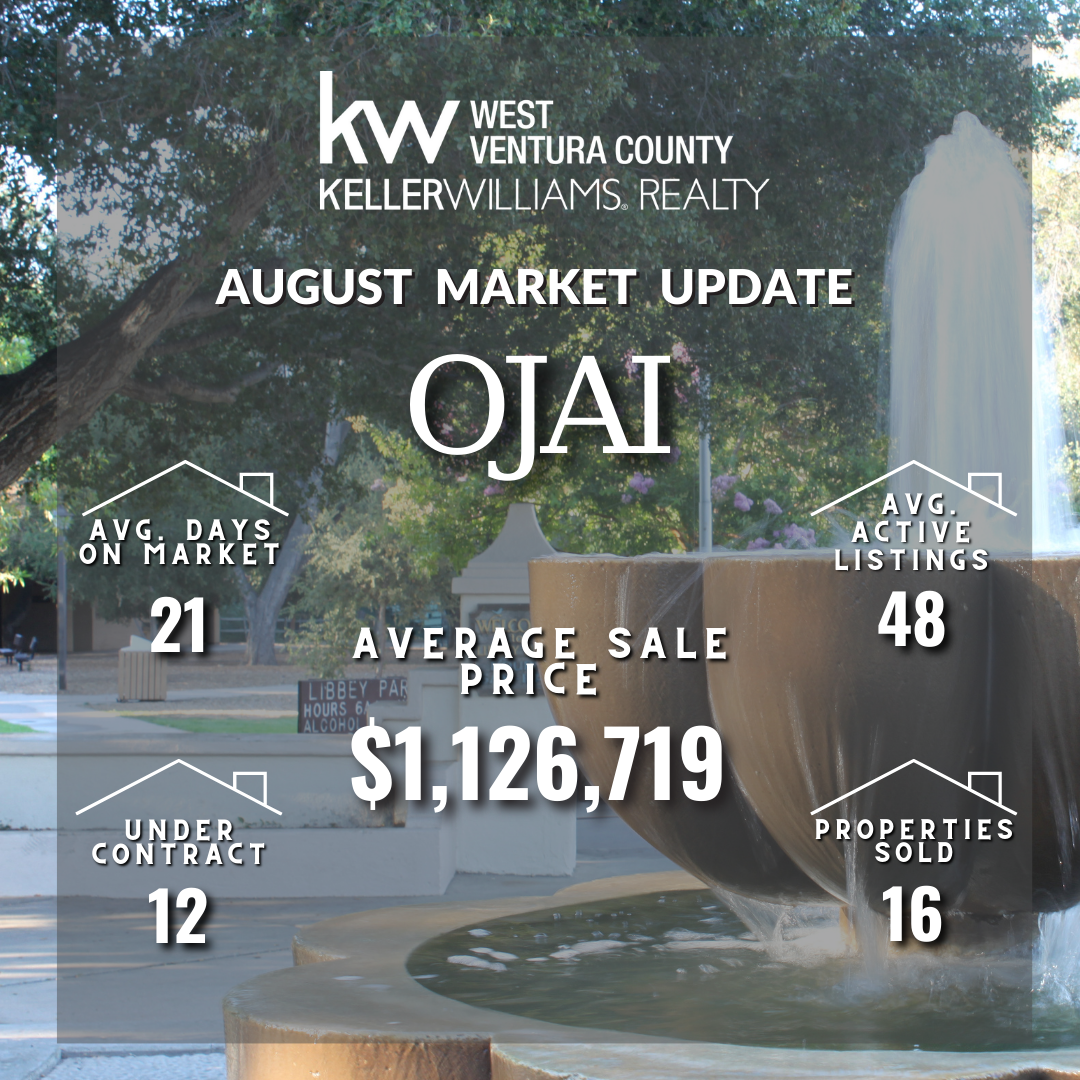

Homes sold in August

Homes sold in June

How to Keep

Emotions In Check When Selling Your Family Home

Being forced to let go of a property that is emotionally significant and carries a lot of fond memories can make this process very difficult. To read the full article, CLICK HERE...

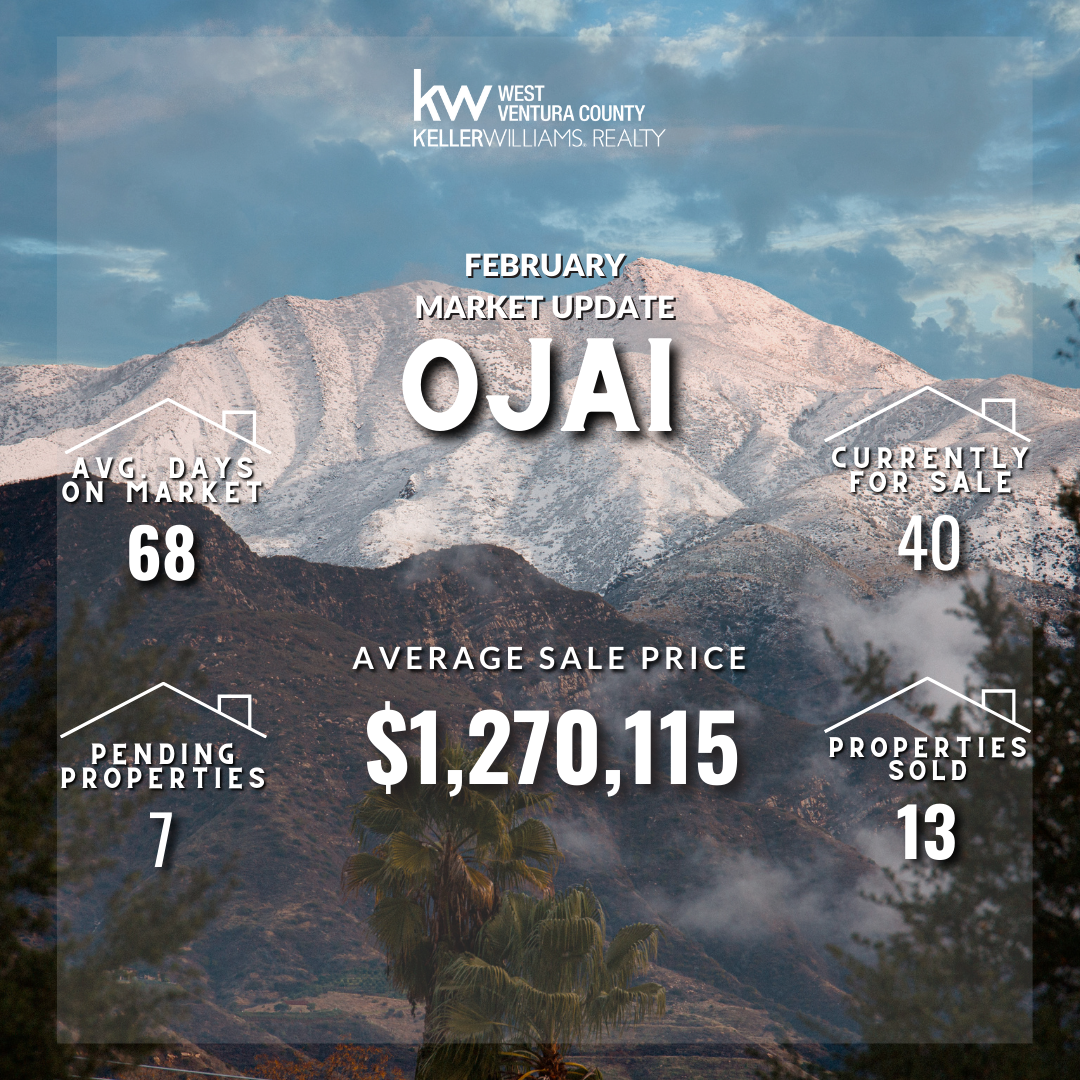

Ojai Market Update For February

Leaving your home and moving to a new one can be a stressful experience. Click HERE to read the full article...

6 New Year's Resolutions for First-Time Homeowners

So, you've decided to buy a home, which means you're probably feeling pretty good about yourself. Who doesn't love being rewarded for hard work and dedication? Click HERE to read the full article

Guide to Selling a House from Afar

It may be challenging to sell a house from a distance, whether it's the next town over or across the country. To read the full article, click HERE....

How to Pick a Real Estate Agent in Ojai to Suit Your Needs

Real estate agents are like real estate itself – many of them are out there. And that can be overwhelming. To read the full article, click HERE...

6 Ways to Research a Neighborhood Before Buying a Home

There are many things to consider when buying a home, as anyone who’s done it will tell you. One of these things is the location and, more specifically, the neighborhood a potential home is in. To read the full article, click HERE...

How to Prepare for a Home Appraisal in Ojai

Did you know that poor appraisal is one of the leading causes of failed real estate transactions?

To read the full article, click HERE...

How Big of a House in Ojai Do You Need?

When searching to buy a house, there is an unwritten rule to choose the most prominent place you can afford. To read the full article, click HERE...

Repairs to Make Before Listing Your House for Sale

Selling your house could sometimes take a little longer than you have anticipated.

TO READ THE FULL ARTICLE, CLICK HERE...

Buying a House As-Is

Buying a House As-Is: What to Consider

Buying a house is a significant moment in everyone's life.To read the full article CLICK HERE

Buying a House in Ojai as a Senior

If you're buying a house as a senior citizen, you'll need to take it very seriously. To read the full article, click HERE.....

Buying a House in Your Twenties

Buying a house in your twenties is not as hard as you think. Yes, this endeavor comes with quite a few responsibilities, but it’s not impossible. To read the full article, click HERE....

Home Inspection Checklist for Buyers

You should, of course, hire a professional home inspector to take a look at any property you are seriously considering buying. TO READ THE FULL ARTICLE,. CLICK HERE...

How to determine the value of your Ojai home

A small, picturesque city in Ventura County, California, Ojai has become a popular relocation place. A lot of families are in search of a quiet and peaceful life. To read the full article, click HERE...

Ojai Neighborhood guide

If you are wondering if you should relocate to Ojai, we vote YES. We're here to help you find the perfect Ojai neighborhood to settle down in

To read the full article CLICK HERE...

Buying A House in Ojai

Buying and owning a house has rarely been an easy task. When the property you want to buy is in a distant location, the challenges multiply. To read the full article, click HERE.

Market Update.

Home Sold in Ojai September 2021

18 homes have been sold in the month of September in the Ojai Valley. For more details click HERE

Is Remote Work Your New Normal?

If your workspace transitioned from an office to your home in 2020, you're in excellent company.

To read the full article, click HERE...

Common fears of first-time buyers

When buying your first home, you'll feel a whole range of emotions, from being excited and joyfully to being overwhelmed, frustrated, and sad.

To read the full article, click HERE...

A Quick Guide to Senior to Downsizing

Are you ready for less house and more life?

To read the full article, click HERE....

Tips for buying a house in a new city

There's always a bit of risk involved when acquiring a residential property. To read the full article, click HERE..

Questions People Forget to Ask Real Estate Agents

When buying or selling a home, you will inevitably have to cooperate with a real estate agent. To be as successful as possible, you want to try and hire the best professional you can find.

Click HERE to read the article........

Ojai July Market Update

How Best to Start a Business While You Are Moving to Ojai

Almost half of all small businesses have a base at home. To read full article, click HERE...

5 Tips for Avoiding Seller's Remorse When Selling Your Home

There comes the point in everyone's life when it's time to make a significant change. To read the article, CLICK HERE..

11 Tax Deductible Expenses for Vacation Rentals

Click on the link:

https://blog.myvr.com/vacation-rental-taxes/

How to Choose The Right Neighborhood For Your New Home

Alt: Picking your future neighborhood is almost as important as picking your future house. To read the article, Click HERE.....

Questions To Ask When Buying A House in Ojai

A significant number of Americans typically spend only a couple of minutes inspecting their future homes before making a purchase. To read the full article, CLICK HERE.

California Home Prices Hit Record High

Never has it cost so much to buy a house in California. For more details CLICK HERE....

Market Update

Home sold in the

Ojai Valley March 2021

As we enter the traditional home buying season, REALTORS® remain upbeat about the current housing market conditions. For more details CLICK HERE

Prop 19 Frees Up Inventory

While Providing Tax Savings for Seniors, Homeowners with Disabilities, and Wildfire Victims

TAX SAVINGS FOR OLDER HOMEOWNERS.

For more details CLICK HERE...

Market Update

Home sold in the

Ojai Valley February 2021

12 homes have been sold in the month of February in the Ojai Valley. For more details click HERE

Market Update

Home sold in the

Ojai Valley January 2021

14 homes have been sold in the Ojai Valley in the month of January. Click for more details..

The Rosario Falvo Blog

Just Sold!!

Gorgeous townhouse in Ventura. Great location near mall and freeway access. The home is a spacious 1,550 sq. ft., has lots of light and is multilevel. There are 3 bedrooms and 2 1/2 baths. For more details click HERE..

Ojai Terrace

Just Sold!!

In the midst of a popular Ojai family neighborhood sits a beautiful, oasis-like custom home with mountain views and close to bike trails. The home has been renovated with artistic and architectural flair. 2,559 sq. ft., 6 bedrooms, 3 bathrooms. Click HERE for more information

How the Rollout of COVID-19 Vaccines Could Help—and Hurt—Ojai & the U.S. Housing Market

The coronavirus pandemic and the ensuing financial crisis have caused immeasurable hardship and pain across the U.S

To read the full article click HERE....

Home Office Design Ideas for Your Remote Business

By Tina Martin.

Are you building up a business that you can run from home? Working from home definitely has its perks, but without a sizable home office, you might find yourself trying to conduct business from your living room couch! To read the full article click HERE..

Ojai Market Updates for September 2020

Home inventory is very low in Ojai

Click HERE for more details.......

Old House Smell: What Is It, and How Do You Get Rid of It?

Old house smell: Those three dreaded words evoke something rather frightening and repellent to most homeowners. You know what we're talking about, right? Click HERE to read the article

5 Affordable Solutions for Staying in Touch with Your Senior Loved One

By Mary Shannon

Keeping in touch when you’re far away is not a new challenge. Fortunately, new and affordable technology can ease your worries and help your senior loved one feel more connected. Try these affordable senior-friendly solutions for staying in contact over long or short distances.

Consider Downsizing (Locally)

While it’s not always an option, getting closer to your loved one in a geographical sense might be a possibility. Many home buyers are even enjoying spectacularly low mortgage rates. If your senior family member – or even your household – is looking to move, now might be a perfect time. Consider reaching out to a local real estate professional, like Ross Falvo, the Ojai Real Estate Guy, for advice and insights.

Of course, if a physical move isn’t in the cards (or budget), you have plenty of other options to stay in touch.

Upgrade to New Devices

Investing in new technology is a smart way to ensure your loved one has the device they need. Less lag time with newer tech also makes the investment worth it. To make the most of your purchase, look for discounts and cashback offers to stretch your dollars. You can find Lenovo coupons that help you save on a laptop or tablet.

Choose a device with a larger screen for better visibility for your senior, and video chatting will become a more engaging experience. Internet capabilities are also a necessity, which leads us to our next recommendation.

Search for Deals on InternetHome internet is a must for a connected household. Reliable internet is available even in rural areas, even if you can’t get broadband. High-speed Wi-Fi is an option in many locations, and it’s a cost-effective option for older adults who may be on a budget.

In many cases, you can also bundle services with an internet package. Your senior can enjoy TV programming and phone service with many bundles – and it could translate to a lower internet bill, too.

Grab Free AppsOnce your senior loved one has a capable device and strong internet, it’s time to get connected. By that, we mean downloading (free) apps for video chatting and other modes of communication.

Video Chat ApplicationsVideo chat is one of the best ways to connect with an older loved one. You can see and hear one another, which can help bridge the physical distance between you. Lifehacker recommends simpler video chat apps, including many options that come pre-loaded on smartphones, tablets, and computers.

For example, Apple’s FaceTime is a built-in option on iPhones, iPads, and Mac computers. Facebook Messenger is a simple app that works with your loved one’s existing Facebook account. Whatsapp is another messaging option that’s popular with the younger set, too – which could mean the grandkids are easier to chat with as well.

Location Sharing AppsLocation-sharing apps can help ensure your loved one’s safety, but they can also help you keep in touch. Free location sharing apps are available on iOS, Android, and other devices.

Learn to Navigate Accessibility SettingsSetting up a new device might be the most complicated part of getting an older adult connected to the internet – and other people. Navigating the accessibility settings on the phone, tablet, or computer can help streamline the tech experience for your senior.

As Popular Science explains, it’s simple enough to make accessibility adjustments that aid your loved one’s visual and audio experience on their device. On Apple devices, specialized accessibility settings give you more customization options.

You can magnify the text on nearly any device, activate hands-free controls, and even have messages read aloud to your loved one. Ideally, you’ll set these things up before the user heads online to enjoy their first video chat.

While you may wish you could spend more in-person time with loved ones, circumstances may get in the way. Fortunately, you don’t have to break the bank to stay connected. Thanks to these budget-friendly solutions, keeping in touch is cheaper and easier than ever.

Photo via Rawpixel

8 Outdoor Kitchen Mistakes That Are Sure To Leave a Bad Taste

Many of us are hanging out at home more than ever, and all that extra time in your backyard may set you daydreaming about having your very own outdoor kitchen.

If so, you aren’t alone. According to a recent survey by Fixr, 41% of construction industry experts expect clients to invest in outdoor kitchens this year.

“The rise in sales for outdoor kitchens has just gone through the roof.”

And the good news is that you don't need a sprawling estate to accommodate one. You just have to think creatively about your space—and know your priorities.

“An outdoor kitchen can seem like an intimidating project, but you get started just like you would with any other space,” says Erin Hopson, outdoor kitchen design team manager at BBQGuys in Baton Rouge, LA.

But just as with any other kind of home improvement project, things can easily go wrong. So if you’re thinking about investing in an al fresco cooking space, do your homework to avoid the following headaches—and ensure delicious results.

1. Not planning for the weather

If you're a homeowner in a cooler climate, you won't be able to use your outdoor kitchen all year long. If you live in an area with frigid, snowy winters, you need to plan the space carefully.

“Depending on how cold your area gets, electrical components like refrigeration units may need to be winterized and stored in a garage or other enclosed structure,” Hopson says.

2. Positioning your kitchen in direct sunlight

Direct sunlight is a no-go for outdoor kitchens.“It’s extremely important, because outdoor refrigeration appliances shouldn’t be fully exposed to sunlight,” Hopson says.On a practical level, direct sunlight can also be annoying. Nobody wants to squint into the sun while trying to enjoy an outdoor happy hour.“Some people can’t even enjoy their kitchen at 6 p.m., because it’s 100 degrees out here,” Robbins says.If you don’t have natural shade, you can create a pergola or roof structure to help protect your outdoor kitchen from the sun.———Watch: Check Out the Top Landscaping Trends of 2020

3. Building with flammable materials

Thinking of building a wooden island for your outdoor kitchen? Think again.

“We strongly advise against building a grill island with wood or other combustible materials,” Hopson says.

Instead, opt for a material like metal, brick, or stone.

“The whole point of the framing is to hold your grill. Why would you put something that creates combustion into something that can easily catch fire?”

If you absolutely must use wood for your BBQ island, be sure to install an insulated jacket around the wood to prevent fires—and don’t put your kitchen right up against vinyl siding, another serious fire hazard.

“You would be surprised at how many times we’ve gone into kitchens people have built, and they framed it in wood and clad it in stone, and the wood has caught on fire because they didn’t put an insulated jacket in it,” Robbins says.

The whole point of an outdoor kitchen is to bring the comforts of home outside," Hopson says. "So having a cramped space will limit the feelings of coziness you’re striving for.”

But you don’t need to live on a sprawling estate to create the outdoor dining space of your dreams. If you’re short on space (or money), consider what you really need in your outdoor kitchen, then tailor the space to your priorities and your budget.

“Maybe you want an outdoor space, but you don’t want to cook,” Robbins says. “I love my countertop and love my refrigerator outside; maybe that’s what you want. You want more of an outdoor entertaining area that doesn’t require a cooking appliance.”

5. Planning your outdoor kitchen like an indoor kitchen

Outdoor kitchens have certain quirks that distinguish them from indoor kitchens. For starters, you probably won’t want to use the kind of cabinetry you have inside the house.

Vent hoods for outdoor kitchens need to be more powerful than indoor models, Hopson says.

She adds that outdoor kitchen cabinets are generally deeper than indoor models, typically from 30 to 36 inches deep. Indoors, they are usually around 24 to 27 inches deep.

“Most people don’t need quite as much storage in their outdoor kitchen,” she says.

6. Choosing a grill that's the wrong size

f you’re putting the energy and investment into an outdoor kitchen, don’t skimp on your most important appliance: the grill.To figure out the right size, Hopson says to ask yourself three questions:How many people will you normally grill for?What’s the maximum number of people you will be grilling for?How often do you expect to grill for the maximum number of people?7. Forgetting to set up the space for entertainingChances are, you want an outdoor kitchen for relaxing—not just for cooking. Don’t forget to think about how the space will function for entertaining.“Think about seating: Do you want a dining table a few feet away from the grill, or would you rather have bar stools lining your outdoor kitchen island?” Hopson says.You may also want to incorporate TVs, sound systems, heating and cooling appliances, and decor, depending on your priorities and budget.“Most of us won’t be planning vacations any time soon, so you might as well start planning your own backyard getaway spot instead,” Hopson says.8. Dropping the ball on maintenanceA new outdoor kitchen comes with a new list of things to keep spotless. It's important to understand what chores you’re getting into.If you have stainless-steel appliances, for example, coat them with a protectant to prevent rust. If you aren’t up to the task of regular maintenance, consider hiring a cleaning service.“Outdoor kitchens are an investment,” Robbins says. “Even though you spent $5,000 on that grill, it does not clean itself. They can last forever, but you need to do a little bit of upkeep.”

Can I sell my house in Ojai during the COVID-19 Pandemic?

Selling a house should always be based on a number of factors, particularly with regard to your family’s health and financial situation. But to cut to the chase: Yes, you can still sell a home during the coronavirus pandemic, particularly now that states are beginning to reopen.

In most markets, inventories are low and prices are high—which means you can still make a profitable sale.

With low inventory and high buyer interest, many homes are selling very quickly—within days or hours in some cases. Interest rates are also low, and there’s serious pent-up demand for homes, especially in lower price ranges.”

Mortgage Rates Are Now Below 3 Percent

If You Know Where To Look

During the coronavirus pandemic, mortgage rates have tumbled to record lows. But many housing experts are predicting they'll fall even more, into the 2% range.How low will they go?

How to Master Some Home Improvement Skills During Your Quarantine Time

Home improvement pros recommend online resources where DIY newbies shacked up at home can learn new skills. To read more Click HERE.....

Home Improvements To Put on

Hold Duringthe Pandemic

While sheltering in place, it's tempting to tackle all the fix-it projects and upgrades you've been wanting to do around the house. Slow your roll, experts say—the time isn't right for some of them. What to consider.......

Why It's Harder Than Ever To Get a Mortgage This Spring

Amid the coronavirus crisis, lenders have raised the bar for home buyers as well as owners seeking to refinance.

Who is at risk, Click here to read more..

The impact of the coronavirus on the housing market

So what state is the housing market in right now, anyway? While that depends on how bad an outbreak an area is suffering, most markets are feeling some sort of hit.

“The coronavirus is leading to fewer home buyers searching in the marketplace, as well as some listings being delayed," says Lawrence Yun, chief economist for the National Association of Realtors®.

The latest NAR Flash Survey: Economic Pulse, conducted on March 16 and 17, found that 48% of real estate agents have noticed a decrease in buyer interest attributable to the coronavirus outbreak.

However, nearly an equal number of members (45%) said that they believe lower-than-average mortgage rates are tempting buyers to shop around anyway, without any significant overall change in buyer behavior.

For those who are determined to buy a home, there is opportunity out there.

“This is the best buyer's market I have ever seen in my career,” says Ryan Serhant of Nest Seekers and Bravo’s "Million Dollar Listing New York."

“Sellers are nervous, there’s excess supply, and interest rates have been hovering at historic lows. You can own a home for less per month than you can rent an equivalent property in most areas," he adds.

With fewer home buyers out there looking, you have less competition in your way.

"Unmotivated and uncommitted buyers have dropped off," adds Maggie Wells, a real estate professional in Lexington, KY. "Less competition is a huge leg up in this market."

The window of opportunity for buyers won't stay open wide forever. NAR data shows that there was a housing shortage prior to the outbreak.

"The temporary softening of the real estate market will likely be followed by a strong rebound, once the quarantine is lifted," says Yun.

This pent-up demand could eventually push home prices higher. That could mean that the time to strike for bargains is now.

Bottom line: If social distancing has made you realize you don't love the place where you're currently spending most of your time, it's a good time to consider buying.

How the housing industry has adapted to keep buyers safe

Although it's a scary time to be out and about checking out real estate, it is still possible to do so and stay relatively safe. The industry has rapidly adapted, introducing approaches that minimize exposure to the virus.

For instance, many agents are now working remotely and conducting most of their business virtually.

"Buyer and seller consultations have transitioned to virtual meetings with success," says Kate Ziegler, a real estate agent with Arborview Realty in Boston.

While open houses or showings may not be easy to arrange because of quarantine or other safety issues, real estate listings have stepped up to the plate by offering virtual tours.

"We can send clients videos of whatever properties they want to see, or we are happy to have our agents FaceTime from a property," says Leslie Turner of Maison Real Estate in Charleston, SC.

While those who are immunocompromised may want to stay home, if you're otherwise healthy, it is also still possible to see some homes in person in some parts of the country. You'll want to take some precautions before you go.

"Hand sanitizer at the door has become the norm, as well as shoe covers, even on sunny days," says Ziegler.

During the tour, it's also now customary for the listing agent to open all doors, so that home buyers can explore closets and other enclosed spaces without touching anything as they look.

If you do make an offer that's accepted and you head to the closing table, real estate agents and attorneys are also adapting to remote closings, to keep you out of a crowded conference room. (We'll provide more information about virtual tours and remote closings in later installments.)

How to weigh economic concerns

Coronavirus aside, anyone thinking about buying a home is also likely to be weighing whether it's a smart idea when the economy is in a downward spiral. But in the same way you can't easily time a stock purchase to make a profit, you can't easily time a home purchase, either.

“Recession or not, it’s impossible to time the market, whether for buying stock or buying real estate,” says Roger Ma, a New York–based financial planner and owner of lifelaidout.

Just keep in mind that while current market conditions offer an incredible opportunity for home buyers to lock in historically low interest rates for a mortgage, rates are actually going up quickly, because so many people are refinancing.

If you wait too long to buy, you may miss the money-saving boat. So make sure to read up on the latest mortgage rates first.

Besides mortgage rates, home buyers are probably wondering about the stability of their income, as fear of layoffs loom.

"We are entering uncharted territory," says Michael Zschunke, a real estate agent in Scottsdale, AZ.

On the flip side, putting a property under contract now and locking in a low interest rate gives a buyer some control at a time of relative uncertainty, adds Turner.

The takeaway from all this? It matters more than ever to get pre-approved for a mortgage, to calculate your home-buying budget accurately.

If you're worried about layoffs, you should buy a home well under budget so you have enough money left over for closing costs, home maintenance, and a rainy day fund. Now is the time to crunch your numbers more carefully than ever before. Below is what you need to consider.

Research ways to reduce your closing costs. For instance, many loans allow sellers to contribute up to 6% of the sale price to the buyer as a closing-cost credit.

Figure out how much you need to set aside for yearly home maintenance and repairs. A smart budget is to have between 1% and 4% of the purchase price of your home.

Be sure to put aside an emergency nest egg for unexpected repairs. On average, it's a good idea to sock away 1% to 3% of a home's value in cash reserves.

In our next installment, we'll explore all the ways to conduct a house hunt safely. Stay tuned! In the meantime, here's more on buying a home during a recession.

Statement from Keith Knox, Treasurer and tax collector, regarding COVID-19 and the April 10 Property Tax Deadline

I understand that this is a very stressful time, especially for those suffering direct effects from this public health crisis, and my office is committed to helping in any way we can. Los Angeles County property owners affected by the COVID-19 virus may have late penalties cancelled if they are unable to pay their property taxes by the April 10 deadline.We have no authority to extend the April 10 deadline, as outlined by State Law. However, beginning on April 11, the day after property taxes are due, people unable to pay on time for reasons related to COVID-19 may submit a request for penalty cancellation online. The department has set up a special team to process these requests for those who demonstrate they were affected by the outbreak.We encourage all property owners who can pay their taxes on time to do so. This revenue helps keep the government running and providing vital services that the public relies on, especially in times like these.Since County buildings are currently closed to the public during this emergency, there will be no in-person payments. Instead, taxpayers can pay online, via telephone or by mail. There is no cost for e-Check payments online. For online credit/debit card transactions, our card payment processor charges a 2.25 percent service fee.We have developed responses to our most Frequently Asked Questions (FAQs).

Please click here for our FAQs

Taxpayers can also visit https://ttc.lacounty.gov/,

to review payment methods and several other online self-service options. Taxpayers may also call (213) 974-2111 for additional information.

All Alone, Together

A message from Bret Bradigan, publisher and Editor of Ojai Quarterly, Ojai Monthly and Ojai Hub. Read HERE...

5 SURPRISING MAINTENANCE TASKS LANDLORDS AREN'T RESPONSIBLE FOR HANDLING

To read the article click HERE..

Can You Afford That House?

If you’re considering purchasing a home, you’ve likely already considered how much you have available for a down payment, what an ideal mortgage payment would be, and how much home you can actually afford based on your monthly income. But what about your lifestyle?Have you considered how much wiggle room you need to leave in your home budget to enjoy life? Here are six life factors to consider when buying a home:

#1 Travel

Travel is an important goal for many people. Think about the travel goals you have for yourself:Where do you want to go?What do you want to see?How long are your ideal trips?How much money would you need on an annual basis to make your travel goals possible?Is this already factored into your budget or will you need to cut back on travel to fund your monthly mortgage payment and home expenses?There are no right or wrong answers, but it’s important to reflect on your priorities.

#2 Green Thumb?

Do you love gardening, being outside, and all things landscaping? If you purchase a home with a lawn and don’t enjoy the upkeep, you could be looking at an extra $100 or more a month for professional landscape maintenance. Are you willing to skip the lawn in favor of hardscaping to reduce costs?Bottom line: Factor hobbies and services into your monthly budget to see if the numbers still work out in the black.

#3 Pool Time

How dreamy would it be to buy a home with a pool!? Before the dream becomes reality, add up the costs of pool maintenance and servicing, energy, and insurance (along with liability if you have small children) and you may be better off heading to the neighborhood swimming hole.Pools can be a lot of fun, but they come with a lot of work. Factor time and money into your future plans when buying a home with this special feature and, once again, ask yourself if the numbers add up to support your other financial goals.

#4 Children

If you’re buying a home and plan to start a family in the next few years, don’t just consider the amount of mortgage you can afford under your current expenses. Factor in daycare costs and then determine what your cash flow will look like. You may have to adjust the amount of home you’re looking to purchase.

#5 Entertainment

Chances are you enjoy dining out, going to concerts and sporting events, and seeing movies. If you need to rein in these activities to make room for your mortgage, home expenses, and savings, aim to strike a balance that won’t leave you feeling restless.After all, you’re likely choosing a 30-year mortgage, and three decades is a long time to feel deprived. If necessary, reduce the amount of home you purchase so you can enjoy yourself in the ways that are important to you.

#6 Retirement

If you’re in your 20s, you should try to save 10% of your income; in your 30s, you should be saving 15%. If you need to cut back on your retirement savings to make a home purchase work, think hard about when you’ll be able to get back to your ideal contribution levels and how much you may be losing out on during that time.Although home ownership can help build long-term wealth, it’s important to also maintain retirement savings for future security.

5 TIMES IT DOESN'T PAY TO FILE A HOMEOWNERS INSURANCE CLAIM

Great insurance policies help homeowners sleep better at night. If something bad happens, at least you can call your insurance company, right?

Click HERE to read more.....

The Link Between Clutter and Depression

It’s been proven. Clutter is a bummer — literally. Click here to read the full article.

The 119th Ojai Tennis Tournament is around the corner. Click here to buy tickets or check the schedule

HOW'S THE HOUSING MARKET RIGHT NOW?

Yeehaw, the latest home-buying season is now in full swing! And if you're

hoping to buy a house soon, listen up: The real estate market changes on a

dime, so if you want to succeed in today's environment, you'll want to take its

temperature and act accordingly.

And buyers are in luck: By and large, this year's home-buying season is a far better bet for buyers than in the past. So if you're craving some intel on what to expect—and how to use this to your advantage—here's the info you need to confidently buy a house right now.

The strong seller's market is on the wane

In the recent past, you weren’t altogether wrong if it seemed like buyers were offering their firstborn child in order for their offer to get a fair look—and often for houses that you would have snubbed in less-sizzling markets. But now it’s OK to breathe—and even sleep on it.

As inventory begins to rise, the strong seller's market that characterized last season's home-buying season is fading fast. In fact, many say we’re back into what can be considered more of a buyer’s market, where the seller doesn’t hold all the cards, says Brad Cox, a real estate agent at the Vesta Group of Long & Foster Real Estate, in Lutherville, MD. That means you’re going to have some wiggle room to negotiate.

“While you still want to prepare a competitive offer, your time window is likely to expand—meaning you can think it over before rushing in with an offer," Cox says. "And you aren’t going to have to include some of the riskier elements, such as waiving financing or inspection contingencies, that were a hallmark of past years."

But what you face still varies by the Big L

You’ve heard the adage "location, location, location," but it will definitely be a huge factor in 2019's home-buying season, Cox says. Because while bidding wars are out in most markets, real estate is still very neighborhood-driven.

“While you might see a softening market in some areas, others may still be in a strong seller’s market," he explains.

He says the key metric to look for is “days on market,” which means how long a property has been waiting to sell. If you’re hoping to buy in an area where days on market are staying low, you’ll have to be prepared to act a little faster. But in areas where this number has started creeping up, you might be able to look around a little more.

For an accurate pricing picture, look only at the latest comps

Both buyers and sellers rely on comparables, aka comps, when determining a fair price. But that can get tricky as the market starts to turn, because sellers might be remembering a months-ago heyday and pricing accordingly.

“Buyers should only consider the most recent comps, which means the last three months, because that is the most accurate reflection of where the market is,” says agent Jed Lewin of Triplemint in New York City.

But don’t forget that it’s still very easy to insult a seller

Yes, the house might have been on the market a few more days than it would have been last year and the comps might be sliding, but that doesn’t mean you can expect that anything goes when you’re buying a home in 2019.

“I am seeing far more buyers starting to make very aggressive lowball offers in an attempt to test sellers’ appetites, even if they’re totally serious about a given property,” says Lucas Callejas, an agent at Triplemint. But in places where the market is still warm, that can turn sellers off—and turn their attention to the next offer that comes along instead of yours.

You may be able to get a better interest rate than you think

One of the big stories of 2018 was rising mortgage interest rates—but while they ticked up precipitously by the end of last year, they’ve fallen a bit again, so you could be in a good spot, says Beatrice de Jong, director of residential sales at Open Listings, in Los Angeles.

Bottom line: Now is the time to lock in a great rate, since today’s appealing numbers might not last long.

“Interest rates are predicted to rise in 2019 and 2020, so buyers would be wise to shop for and lock in their interest rate as soon as possible,” de Jong says.

Increasing rates can make a huge difference, she points out, noting that the difference between a 5% interest rate and 5.5% interest rate is $93 a month on a $300,000 mortgage loan, which can easily derail a buyer’s budget.

So even if you are trying to improve your credit or save a few more bucks for the down payment, you might be better off just wading in and locking in the rate, says Jason Lerner, vice president and area development manager for George Mason Mortgage, in Lutherville, MD.

“You might work for three months to burnish your credit, and then find that the rate has risen so much that it doesn’t make a difference,” he adds.

Your credit score might be better than you thought

Two recent developments in credit scoring may help would-be buyers: One is the new UltraFICO, which takes into account how you manage your checking, savings, and money market accounts, in addition to your credit cards and consumer loans. And the second is Experian Boost, which adds your utility and cellphone bills into the mix.

But even if you have a stellar record in all those areas, there’s no guarantee these will be your golden ticket, cautions Lerner. That’s because it’s still early days for these initiatives: UltraFICO is currently available only in a pilot phase in certain areas, and Experian has yet to launch the booster product, although it is taking sign-ups. But as these products become more widely available throughout the year, home buyers may reap the benefits.

“A difference in 10 or 20 points to your credit score can make a difference between approval or denial—and can lower your rate, which can save thousands over the life of a mortgage,” Lerner points out. He also predicts that requirements will loosen a bit in 2019: “You might not think your credit is good enough for a mortgage, but it’s worth talking to a lender to see if there is a program out there that can help.”

The Perfect Accessible Home for You in the Golden State

There’s a reason so many people say the West

Coast is the best coast. States like California have a lot to offer in

recreation, travel, scenery and culture. With some patience and investigation,

you’re certain to find the perfect home for you. If you’re looking for details

on how to find an accessible and safe home and make moving as stress-free as

possible, look no further. This article will discuss the importance of finding

the right location, choosing the right home, moving, and making your house your

home.

Location, Location

Finding the right home can be a lengthy process, but it’s not impossible. Always start with finding the right location. If you start by looking for the right home right out of the gate, you will become overwhelmed and it will feel as though you are looking for a needle in a haystack.

Limiting your home options to one geographical location will make your hunt manageable. Employ online resources and realtors geared toward house hunters with disabilities to narrow your search and provide you with details and insights. Once you have limited your house hunt to a single location, it’s time to find the right home that meets your needs.

Good Bones

Unless you are building a home from the ground up (which may be an option if you find the right space and have the funds), you need to look for a home that meets most of your needs and with a little work can be made into the perfect space. If you have difficulties with walking, balance, or energy, then a one-story home with few to no stairs would be a perfect option.

If you or a loved one require a wheelchair or similar equipment, then wider doorways, hardwood floors, lower bathroom fixtures, accessible switches and ramps would be essential; but those are cosmetic features that can be added later. The key is to find the right bones on a house, which includes a sturdy foundation and a solid structure.

Moving Made Easy

Finding the right home is a mix of feeling excited and overwhelmed, but once the right home is found, for many, the move is the most dreaded part. A professional packing and moving company can make your life and your move 100 percent easier. Not all packing and moving companies are created equal. Search reviews, call for quotes, and check out companies in your proximity. Using a professional will ensure you’re not struggling to get your belongings moved and you can rest assured it’s handled quickly and efficiently.

Once the transfer of the property is complete and you get the keys to your humble abode, you should immediately change the locks to ensure your safety and security from unwanted guests. Scheduling an appointment with a local locksmith right away will enable you to rekey your house quickly so you can move on to getting settled.

It’s Your House, You Can Do What You Want to

Depending on your needs, you may need to make certain improvements, adaptations and alterations before you move in, while others can wait until you’re all settled. To allow for improved mobility and to help prevent accidents, you may need to install hardwood, laminate or pergo floors prior to the big move.

You also may need to have an electrician come in to install new lighting switches and outlets that are height accessible. A plumber could install the right-sized toilets and bathroom fixtures. Depending on your needs, ramps and rails could be installed prior to move-in or after. After you move in, then you can make your yard more accessible with pathways and raised beds.

While finding accessible homes can often be difficult and overwhelming, California is a great place to consider. Utilize online resources and realtors to choose a location, and pick a house with good bones that can be modified to meet your needs. Finally, consider hiring professional movers to make your experience less stressful, and make any modifications necessary for your home to be comfortable and safe.

Photo Credit: Pexels

Tax Changes for 2019 Change the Landscape for Home Owners

Tax season is upon us once again, and to make it even more interesting this year, the tax code has changed — along with the rules about tax deductions for homeowners. The biggest change? Many homeowners who used to write off their property taxes and the interest they pay their mortgage will no longer be able to.Stay calm. This doesn’t automatically mean your taxes are going up. Here’s a roundup of the rules that will affect homeowners — and how big of a change to expect.

Standard Deduction: Big Change

The standard deduction, that amount everyone gets, whether they have actual deductions or not, nearly doubled under the new law. It’s now $24,000 for married, joint-filing couples (up from $13,000). It’s $18,000 for heads of household (up from $9,550). And $12,000 for singles (up from $6,500).Many more people will now get a better deal taking the standard than they would with their itemizable write-offs.For perspective, the number of homeowners who will be able to deduct their mortgage interest under the new rules will fall from around 32 million to about 14 million, the federal government says. That’s about a 56% drop.“This doesn’t necessarily mean they’ll pay more taxes,” says Evan Liddiard, a CPA and director of federal tax policy for the National Association of REALTORS® in Washington, D.C. “It just means that they’ll no longer get a tax incentive for buying or owning a home.”So will you be able to itemize, or will you be in standard deduction land? This calculator can give you an estimate.If the answer is standard deduction, you’ll be pleased to know that tax forms are easier when you don’t itemize, says Liddiard.

Mortgage Interest Deduction: Incremental Change

The new law caps the mortgage interest you can write off at loan amounts of no more than $750,000. However, if your loan was in place by Dec. 14, 2017, the loan is grandfathered, and the old $1 million maximum amount still applies. Since most people don’t have a mortgage larger than $750,000, they won’t be affected by the cap.But if you live in a pricey place (like San Francisco, where the median housing price is well over a million bucks), or you just have a seriously expensive house, the new federal tax laws mean you’re not going to be able to write off interest paid on debt over the $750,000 cap.

State and Local Tax Deduction: Degree of Change Varies by Location

The state and local taxes you pay — like income, sales, and property taxes — are still itemizable write-offs. That’s called the SALT deduction in CPA lingo. But. The tax changes for 2019 (that’s tax year 2018) mean you can’t deduct more than $10,000 for all your state and local taxes combined, whether you’re single or married. (It’s $5,000 per person if you’re married but filing separately.)The SALT cap is bad news for people in areas with high taxes. The majority of homeowners in around 20 states have been writing off more than $10,000 in SALT each year, so they’ll lose some of this deduction. “This is going to hurt people in high-tax areas like New York and California,” says Lisa Greene-Lewis, CPA and expert for TurboTax in California. New Yorkers, for example, were taking SALT deductions averaging $22,000 a household.

Rental Property Deduction: No Change

The news is happier if you’re a landlord. There continue to be no limits on the amount of mortgage debt interest or state and local taxes you can write off on rental property. And you can keep writing off operating expenses like depreciation, insurance, lawn care, and utilities on Schedule E.

Home Equity Loans: Big Change

You can continue to write off the interest on a home equity or second mortgage loan (if you itemize), but only if you used the proceeds to substantially better your home and only if the total, combined with your first mortgage, doesn’t go over the $750,000 cap ($1 million for loans in existence on Dec. 15, 2017). If you used the equity loan to pay medical expenses, take a cruise, or anything other than home improvements, that interest is no longer tax deductible.Here’s a big FYI: The new rules don’t grandfather in old home equity loans if the proceeds were used for something other than substantial home improvement. If you took one out five years ago to, say, pay your child’s college tuition, you have to stop writing off that interest.

4 Tips for Navigating the New Tax Law1. Single people may get more tax benefits from buying a house, Liddiard says. “They can often reach [and potentially exceed] the standard deduction more quickly.” You can check how much you’re likely to owe or get back under the new law on this tax calculator.

2. Student loan debt is deductible, up to $2,500 if you’re repaying, whether you itemize or not.

3. Charitable deductions and some medical expenses remain itemizable. If you’re generous or have had a big year for medical bills, these, added to your mortgage interest, may be enough to bump you over the standard deduction hump and into the write-off zone.

4. If your mortgage is over the $750,000 cap, pay it down faster so you don’t eat the interest. You can add a little to the principal each month, or make a 13th payment each year.

What are Granny Pods?

After children grow up and leave the nest, their parents may enjoy their newfound freedom for a while. But as those parents grow older, they and their adult kids may think about living close together again—but in a way that preserves everyone's independence. Enter the granny pod, an affordable living solution for retirees wanting to downsize.

What is a granny pod?

Basically, a granny pod is a small modular home, typically between 300 and 500 square feet, that sits in the backyard of a main house. Think of it as an in-law unit that's designed to be easier to navigate for elderly folks who may have difficulties with mobility or vision.While the tiny space is ideal for one person, couples can certainly live in the space, too. Like a tiny house, each granny pod typically has a bedroom, living room, kitchenette, and bathroom. Also, the unit is mobile, so that if the whole family relocates, Grandma's pod can come, too.

Benefits of a granny pod

What makes a granny pod particularly suitable for seniors are the universal design features such as wide doorways (to allow wheelchair access), an open floor plan, and a walk-in shower.“For those needing more advanced medical care, some granny pods feature a virtual system that can track one’s blood pressure, glucose levels, heart rate, and blood gases, and share that information with the occupant’s family and physician."Some systems are also equipped to verbally remind the occupant to take their medications.”Some granny pods are also designed with voice-controlled smart home features such as door locks, lighting, heating, and window shades. Others are built with more advanced medical amenities like pressurized ventilation systems to keep outdoor air from leaking inside if the resident has a compromised immune system.

How much does a granny pod cost?

The price of a granny pod can range from $40,000 to $125,000, depending on the size and the amenities included, and since you can't take out a mortgage for one, that will need to be paid upfront. On the other hand, the amount is comparable to a down payment on a regular home in some states This is not the case of Ojai where a median price is around $670,000. Also, since the pod will share water, sewer, and power with the main house, the property owners will likely see an increase in their utility bills.

Disadvantages of owning a granny pod

If you are considering a granny pod, it’s important to be aware that your property may not be zoned for the addition of an alternative living unit like a guesthouse or granny pod.“Although some communities have zoning laws which are pod-friendly, in most cases there are several restrictions to follow.” “Also, not all states will allow one to have a granny pod in their backyard. Therefore, be sure to inquire with your city planning office about the process of building on your property and the type of permits you'll need.

Granny pods and multigenerational living

Over the past several years more and more homeowners have expressed interest in them when looking for a home to buy.

Granny pods can keep the family together, eliminate high nursing home costs, and allow the elderly to keep their privacy and their dignity.

Thankful on Thanksgiving

May this day of gratitude bring the opportunity to break bread and share appreciation for the family and neighbors that make your house your home.

Ojai Market Update

Did You Know?

With the median home price of $860,000 in our market, you could buy 2,497 wireless Beats headphones. Take calls, control your music and activate Siri with the multifunction on-ear controls!

Funny, but also true. Click here to see where we got these numbers.

Meanwhile, in Oiai were sold 25 homes. The less expensive was located at 410 Church Road #53, a little condo with 1 bed and 1 bath, 742 square feet listed at $380,000 and sold at $335,000, 187 days on the market.

Most expensive home was sold at 715 El Toro Road, 6 bed, 7 bath, 6089 square feet, listed at $6,500,000 sold at $6,265,000 92 days on the market.

Only 4 mobile homes were sold in October.

The less expensive was located at 1202 Loma Drive #67, 2 bed, 2 bath, 1248 square feet, Listed and sold at $129,000. Built on 1978 with a space rent of $735.00 per month.

The most expensive mobile home was located at 133 Don Felipe Way, 2 bed, 2 bath, 1344 square feet, 29 days on the market, built in 2004. Listed and sold at $225,000. 29 days on the market with a rent space of $735.00 per month.

Home Sweet (And Smaller) Home: A Downsizing Guide For Seniors

By Michael Longsdon

We’re not talking about your waist, but your

home. According to recent data, the average home is 2,700 square

feet, nearly twice that as homes built in 1970. And it’s not that families have

gotten bigger, just our appetites for stuff. Evidence suggests, however, that

living in a smaller home can make you happier. If you’re a

senior, downsizing is a smart move for reasons that go beyond your happiness.

For instance, less space means fewer hours spent cleaning. You’ll also pay less

in taxes and utilities.

Easing in to the process

Once you have made a decision to downsize your home, your first task is to determine where you want to live. If you’re staying in your hometown, you likely already know the ins and outs of every neighborhood and the best location to put you in proximity to your friends and family. But if you’re moving more than just a few miles away, make sure to research your preferred area online to determine the average price of real estate, crime rates and the types of activities you can expect to find in your new hometown. For example, Ojai, California, which is a popular area for retirees, has an average selling price of approximately $694,000. When you narrow your target location down, consider spending a long weekend in the area. Alex Schechter of The Points Guy blog details how to do just that in Ojai.

Home type

Knowing which type of property you want is second only to location in importance and for quality of life. If you are on a budget or wish to live in close proximity to your neighbors, a condominium or townhouse is a wise choice. A single story, ranch-style home is a better option if you have mobility or visual impairments that pose a threat in stairways. Whichever type of home you choose, assess whether or not it has options and features that can help you age in place and enjoy your golden years safely.

Pack and prep

The packing, purging, and preparation portion of a move is perhaps the least pleasurable part of the process. If you start early, you’ll have more time to sort through the decades’ worth of belongings you no doubt have stored in every nook and cranny of your current home. Start with the areas that don’t typically see the light of day. This will likely be the garage, attic or basement, which often serve as the space things go to collect dust. After these areas have been sufficiently purged, you’ll need to consider getting rid of a few items that won’t fit into your smaller home. MyMove.com recommends looking at the rooms you won’t have and determining which items in those spaces can be sold, thrown out or donated.

Let go of heirlooms

It’s often hard to get rid of personal possessions. It’s even more difficult when these belongings have been passed down through your family. But now is the perfect time to bequeath family valuables to your loved ones. Your grandfather's fiddle, for example, may be a great gift for musically inclined grandchild. The most sentimental family heirlooms, photographs, recipe boxes, handmade quilts, etc., are the hardest part with. It’s these sentimental assets that also tend to cause the most friction. You can do yourself and your family a favor by personally giving these items now instead of trusting that your estate will be settled according to your wishes when you pass on.

Whether you’re moving out of necessity or for a fun change of scenery, it takes planning, especially when you’re purging a place you’ve called home for decades. Begin the process by researching online so you can make informed decisions regarding your living arrangements.

3 TIPS FOR HOME WILDFIRE PROTECTION

How do most homes ignite during a wildfire? A

floating ember or piece of burning wood touches down on a roof, gutter, in a

vent, under a deck, or on a porch and ignites leaves and debris, says the

National Fire Protection Association. Or else, a surface fire simply takes the

fast lane to your home via dry vegetation.

With that in mind, fortify your home like the castle it is with these 13 wildfire-repelling steps. But keep in mind that no product or technique is a failsafe against a raging fire.

#1 Check Smoke and Carbon Monoxide Detectors

If you don’t already have working smoke detectors or haven’t tested them recently, make that your No. 1 job. Now.

#2 Check Fire Extinguishers

And if you don’t have them, get them.

#3 Get a Bucket, Shovel, and Hose Ready

Have an easily accessible bucket, shovel (to dig a trench against encroaching ground fire), and connected garden hose to help you defend the area around your home.

#4 Invest in Rain Barrels

An extra source of water can’t hurt. And rain barrels save on your water bills, too.

#5 Clear Yard of Debris

Keep gutters, porches, and the lawn free of debris, leaves, and fallen branches. If a fire threat is imminent, remove furniture and decorations from decks and porches, including welcome mats.

#6 Plant Fire-Resistant Shrubs and Annuals

Like irises, rhododendrons, hostas, and lilacs, which have high-moisture content. Your local Cooperative Extension Office can advise you on an appropriate species for your area.

#7 Remove Tree Branches Lower Than 6 Feet

Fires tend to start low and rise. For that reason, don’t plant shrubs directly under trees; they can combust and cause the fire to rise up the tree. By the way, spacing out all plants and shrubs is a good practice, too.

#8 Remove Tree Limbs Near Chimneys

Keep them at least 10 feet away. Embers from burning limbs could fall in.

#9 Set Up a Protective Perimeter

Create a 100-foot perimeter around your home, free of dry leaves, grass, and shrubs that fuel wildfires. Keep petroleum tanks, cars, and wood piles outside of this safe zone.

#10 Use Rocks Instead of Mulch Next to the House

Lay a six-inch swatch of decorative rocks closest to the home and then use mulch from there. This also helps repel insects, like termites, (bugs like wood) and facilitate rain water drainage.

#11 Use Non-Flammable Fencing

If you have wood fencing around your home, replace any three-foot sections that attach to the home with metal or other non-flammable fencing material. A metal gate or decorative fencing piece is stylish as well as fire-friendly.

#12 Cover Chimneys and Vents With Flame-Retardent Mesh

And it’s cheap to do. They cost just a few dollars from hardware or home improvement stores.

#13 Check Your Siding

Fire-resistant or non-combustible siding like stucco or brick provides the best protection against fire. Make sure your siding, whatever type, is in good repair, because if the plywood or insulation are exposed, the home is more vulnerable to flames.

Some experts recommend spraying homes with fire retardants, which can range from a few hundred to a few thousand dollars, depending on the product, region, and size of the project. But some of the chemicals used to make flame-retardants have toxic properties. Although you might have less exposure to chemicals used on your home’s exterior than those inside, toxicity issues could still be a factor.

Most important, if a wildfire is on its way, evacuate. And have an evacuation plan worked out with your family before the worst happens.

Did You Know?

With the median home price of $699,500 in Ojai market, you could buy 2,331 one-way flights to Paris! Today is World Tourism Day, and France is the most visited country in the world with around 89 million visitors just in the past year!

Funny, but also true. Click here to see where we got these numbers.

Ojai Market Update

Homes sold in Ojai in August

With the median home price in Ojai of $641,000 you could buy 58,180 flying pig toys. Anything is possible when pigs fly!

Funny, but also true. Click here to see where we got these numbers.

Meanwhile in Oiai were sold 20 homes.

The less expensive was located at 848 Woodland Avenue, a little condo with 1 bed and 1 bath, 666 square feet listed at $269,900 and sold at same price $269,900, 40 days on the market.

Most expensive home was sold at 888 Baldwin Road, 5 bed, 4 bath, 3703 square feet, listed at $1,990,000 sold at $1,830,000 269 days on the market.

Only 4 mobile homes were sold in August.

The less expensive was located at 12135 South Rice Road #45, 1 bed, 1 bath, 800 square feet, Listed and sold at $82,500 built on 1964 with a space rent of $598.33 per month.

The most expensive mobile home was located at 98 Don Carlos way, 2 bed, 2 bath, 1440 square feet, 69 days on the market, built in 1972. Listed at $217,000 sold at $235,000, 30 days on the market with a rent space of $598,29 per month.

6 Ways to Lose at Negotiating a House Price

You’ve looked at enough houses to fill an entire season of House Hunters and finally picked one to buy. Now you’re ready to make an offer.Your agent can help guide you through this nail-biting phase of negotiating a house price, but ultimately, you call the shots. Here’s how to negotiate like a boss.

Fail #1: Thinking House Price is All That Matters

That house with a price point $15k below your budget? It may seem like a deal — until you add on the costs of maintenance and replacing the aging appliances. Planning on repainting, remodeling, or landscaping, too? Suddenly the price looks a whole lot higher. When developing your offer, calculate in the costs that will go above and beyond a mortgage payment. Then you can negotiate with an eye on the total cost of owning the house, not just the sticker price. On the flip side, the price may not be all that matters to the seller, either. She may have to start a job on the other side of the country in a month and value a quick closing. Or she may be looking to rent from you for a bit after the sale until her next home is ready. Sometimes being accommodating is negotiation gold.

Fail #2: Refusing to Back Down on Small Repairs.

Before you draw a line in the negotiation sand over, say, a deck with some rotten boards, ask yourself if it’s worth losing the house over a repair that would cost less than a thousand dollars. Say the house price is $250,000, which makes that deck repair less than half of one percent of the cost of the house. There’s a lot of emotional energy at this point in the process, so give yourself a break rather than dickering over it. A house negotiation is not about winning for the sake of winning. It’s about getting the house you want at a fair price on good terms.

Fail #3: Waiving Formalities Because You’re So in Love With the House

Don’t be so blinded by house love that you do something silly like skip some of the formalities of home buying, such as the home inspection or the appraisal, in an effort to close the deal.Those steps, and others like a termite or septic inspection, are known as contingencies. They’re there to protect you from ending up with a six-figure money pit. Imagine how quickly the house-honeymoon would end if you found a termite colony or that the identical house across the street sold for much less? Besides, if you’re taking out a mortgage, your lender won’t let you skip an appraisal because they don’t want to loan money on a house that isn’t worth the loan amount. So even if you want to make it easy for the seller, your lender may stop you.There are other ways to sweeten your offer and get that house:Pay some of the seller’s closing costs. Offer a fast close If this is your first house, speed is an ace up your sleeve because you can move faster than someone who can’t buy a new house until they sell the old one (another type of contingency). And remember, while there’s a lot of emotion tied up in choosing a house, it’s still a business deal.

Fail #4: Getting Hung Up on a Few Grand

You offered $198,000. The seller won’t budge from $200,000. Before you walk away, consider this: Two grand is a lot of money, but in the house-buying world it’s not so much. At an interest rate of 4%, with 20% down on a 30-year mortgage, that additional $2,000 will add just $8 a month to your payment. If you can swing it — maybe you can cut a small thing out of your budget each month — it could be worth it.

Fail #5: Folding Because the Inspection Turned Up Issues A good home inspection is going to turn up something. Usually several somethings. That’s good. It means the inspector is doing their job. It’s a rare day when a home passes inspection with no problem at all.Plus, many things that turn up on an inspection are easily handled. You can ask the seller to do the repairs or knock some off the price so you can pay for repairs. And while some problems may seem scary at first, like a roof leak or plumbing problem, they’re almost always fixable and negotiable.

Fail #6: Offering Less Because the Décor is Hideous

The faux-Tiffany swag lamp and trippy orange-and-brown wallpaper make your eyes itch. So you’re planning on offering less — way less. Before you do that, know the market. If it’s a seller’s market, your offer may be seen as an insult especially if the home’s in good shape. And just like that, you’ve lost your dream home. When you’re ready to make that offer, look past the little stuff that you can easily change, and focus your negotiations on what matters, like the location and the bones of the house.

Did You Know?

Did You Know? With the median home price of $695,000 in Ojai, you could buy 28 Harley Davidson motorcycles. Harley Davidson is celebrating their 115 year anniversary today in Milwaukee, so there's no time like now to cruise on over and nab a deal on a new bike!

Funny, but also true. Click here to see where we got these numbers.

House-Hunting Tips To Avoid

#Facepalm Moments

The only thing more exciting than shopping for your first house is the day you move into it. And in your eagerness to get to that day, there are a bunch of opportunities to botch the shopping.Here are some #facepalm moments and the house-hunting tips you’ll need to avoid them."

I Saw the House Online. It's Perfect — Let's Make an Offer Before It's Gone!" Buying a house sight unseen?!? Whoa. Online photos are a fun sneak peek — and that’s all.

Before you plan marriage after the house equivalent of swiping right, consider this:It’s the photos that aren’t in the gallery you should worry about. You won’t see the hastily patched cracks in the home’s foundation. Or the mold in the attic.Your other senses need to evaluate the place. There could be traffic rumbling by or a stinky recycling facility downwind.Three words: Wide angle lens. (They make small spaces look deceptively big.)So before you make an offer, tour the place. And the yard. And the neighborhood. It’s worth it.

"I Want to Buy This House. And Look, There's an Agent Right Here!"

While that might seem mighty convenient, it’s not in your best interests. The real estate agent at an open house most likely represents the seller.That means they’re obligated to work in that person’s best interest. If you start blabbing about how you’re pre-approved for $285,000, but you’d rather offer $260,000, you’ll compromise your negotiating position.As a buyer, you should contract with a buyer’s agent who works on your behalf. They’ll understand your wants and needs, counsel you based on your budget and priorities, and advise you through the negotiating process.

"I'll Rely On an Online Home-Value Estimator."

Google “home-value estimator” and you’ll get pages of tools that promise you a free estimate of home value. Plug the address into the tool, some algorithms do their thing, and in seconds you know what a house is worth.But unless that algorithm’s been poking around the basement with a flashlight, it’s a ballpark figure at best.Home valuation is both art and science. There are nuances within house and market that an online estimator just can’t see. What if the seller made major renovations last year? Or what if houses rarely turn over in the neighborhood, so there’s not enough data to work with online?Your agent knows current market conditions and the inventory of homes in the market — all of which help you make a nuanced offer.Use these fun tools as a guide, but don’t take them to the bank.

"I Don't Have Kids, So I Don't Have to Worry About School Districts."

Yeah … nope. School district matters regardless of your parenting status. Whether or not you have kids, a future buyer might. And neighborhoods with good school districts tend to maintain value and appreciate faster than those in other areas. People want to live near good schools, which leads to rising home values and better neighborhood amenities.

"If a House Doesn't Have Everything On My List, I'm Not Looking At It."

Definitely make your list. Your list is important. But use it as a starting point to help you prioritize. Because buyers who can prioritize have the most success.They turn that list into must-haves and nice-to-haves — and they also consider which of their must-haves could turn into will-dos.For example, you can switch laminate for quartz, but you can’t move a country home next door to your city office. Skip the listings that are in the wrong location, but why not check out the ones with the wrong countertops? Maybe the one thing you’d enjoy more than quartz counters are quartz counters you picked out yourself.

"I'll Figure out This HOA Thing After Closing."

Homeowners associations (HOAs) might just seem like a cute little neighborhood organization, but some have the power to limit your pets, restrict your parking, and pick your paint colors.Since how you live is likely as important to you as where you live, read and fully understand the covenants, conditions, and restrictions (CC&Rs) before you buy. Restrictions that don’t fit your lifestyle could be as much of a deal breaker as a crumbling foundation.That’s not to say HOAs are bad. Oh no — they can be great at preserving neighborhoods, keeping home values high, and some give you access to amenities. But the benefits and drawbacks of each one vary, so take a close look.

Ojai Market Update.

Homes sold in June 2018

Housing Starts Fall 12.3 Percent as Tariffs Draw Increased Concern

Total housing starts fell 12.3 percent in June to a seasonally adjusted annual rate of 1.17 million units, according to newly released data from the U.S. Department of Housing and Urban Development and the Commerce Department.

The June reading of 1.17 million is the number of housing units builders would begin if they kept this pace for the next 12 months. Within this overall number, single-family starts fell 9.1 percent to 858,000 units. Meanwhile, the multifamily sector — which includes apartment buildings and condos — dropped 19.8 percent to 315,000.

Overall, permits — which are a sign of likely future housing production — dropped 2.2 percent to 1.27 million units in June, the lowest level of the year. Although single-family permits edged up 0.8 percent to 850,000, they remain at their second lowest reading of 2018. Multifamily permits fell 7.6 percent to 423,000.

Meanwhile, this is what happened in Ojai in June.

We had a total of 21 homes sold.

The most affordable home was located at 229 Apricot Street in Oak View. 2 bed, 1 bath 952 square feet with a lot size of 5650 square feet. Listed at $439,500 and sold at $427,500 after only 15 days on the market.

Most expensive house was located at 1420 Daly Road, 4 bed, 4 bath, 4240 square feet with a lot of 7.3 acres. Listed at $3,895,000 and sold after 756 days at $2,850,000.

Total median price for the valley is $670,000. Days on the market: 173

Only 2 mobile homes were sold in the valley in the month of June.

950 Woodland Avenue #12 (Family park) 3 bed 2 bath, 1536 square feet built in 1974, listed at $149,000 sold at $132000 after 96 days on the market. Days on the market: 85

1273 South Rice Road #95. (Senior park). 3 bed 2 bath, 1248 square feet. Built in 1989. Listed at $195,000 sold at $194,000 after 44 days on the market.

Ojai Market Update, May 2018

A Home Sale Report for the Ojai Valley. Click to read more....

Are You Ready To Graduate From Renting to Owning a Home?

With graduation season in full swing..... To read the article click HERE....

How To Price Your Home

THE INS AND OUTS OF PRICING A HOME

Click here to read the full article

Ojai Market Update, April 2018

A Home Sale Report for the Ojai Valley. Click to read more....

118th Ojai Tennis Tournament

The Ojai Tennis Tournament is back. April 25 to April 29

WHEN IT'S TIME TO GET AN ACCOUNTANT TO DO YOUR TAXES

Federal law signed by president Trump may affect home ownership tax benefit. To read the full article click HERE....

5 Reason to Sell Your Home Early in 2018

Why should you sell your home early in 2018.

To read the full article click HERE...

Ojai Market Update, January 2018

A home sales report for the Ojai Valley. To read the full article click HERE.....

Did I miss this month mortgage payment?

What happen if we miss a mortgage payment?

To read the full article click HERE

An incredible interview by

Sarah Howery

Click HERE to read the full interview

Local Hero

One of Ojai finest interviewed by

Sarah Howery

Click HERE to read the full interview

Should I use a mortgage broker or find my own lender?

This is a questions we ask ourselves so many times. To read the article click HERE

Ojai Film Festival 2017

80 films plus Johnny Jensen, Ed Asner and Cloris Leachman to be honored. to read this nice article written by Sarah Howery click here

Ojai Day Celebration 2017

Are you ready for Ojai Day? To read the full story click HERE.....

The 7 Worst Habits Homeowners need to Break Now

To read the full story click HERE....

Ojai Market Update, August 2017

An other good month in Real Estate

click HERE... to read the full article

Have you Fallen Out of Love With Your House? Here is Why

To read the full article click HERE.....

An interview with Rob Tucker, owner of Jim & Rob

By Sarah Howery Hart

To read the full article click HERE....

SELLING YOUR HOUSE? BETTER PREPARE FOR THE HOME INSPECTION

To read the full article click HERE.....

Ojai Storytelling Returns

By Sarah Howery Hart

To read the full article click HERE.....

Australian Native Plants Handling Drought

By Sarah Howery Hart

To read the full article click HERE...

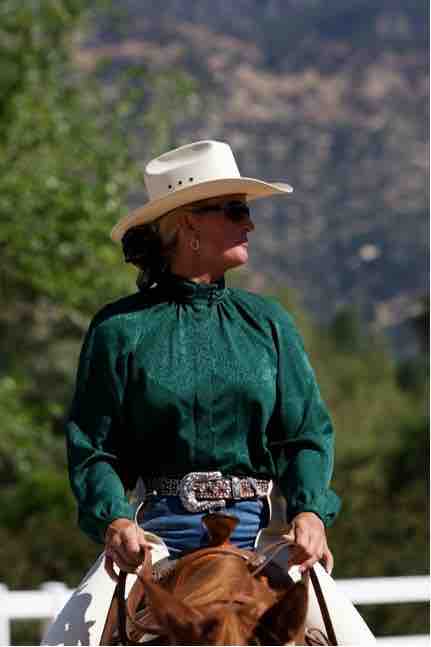

Local “Horse Crazy Girl” Offers Happy Trails,Throughout the Ojai Valley

By Sarah Howery Hart

To read the full article click HERE....

Playwrights to Celebrate 20th Year in Ojai

By Sarah Howery Hart

From August 6 to 13, the Ojai Playwrights Conference (OPC) will celebrate its twentieth anniversary,

To read the full article click HERE...

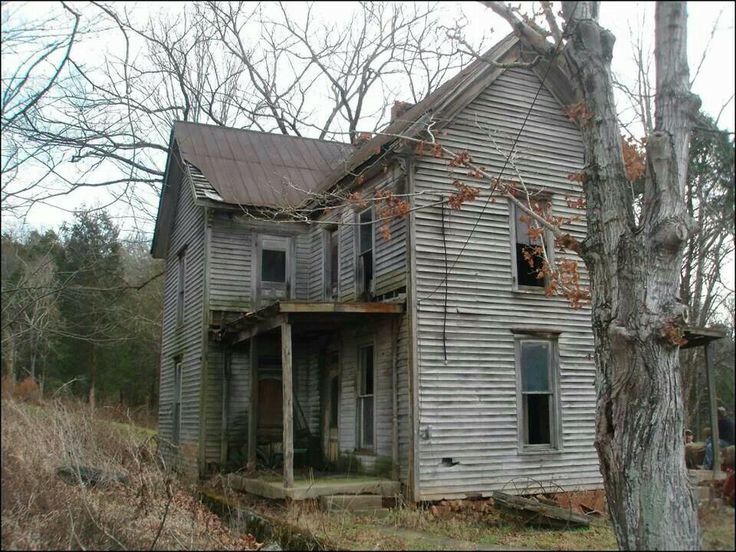

Fixer Upper House

Trying to decide whether to buy a fixer-upper house?

To read the full article click HERE.....

Ojai's Double Celebration: Fourth of July & Ojai's 100 Years

By Sarah Howery Hart

To read the full article click HERE...

Ojai Market Update June 2017

To read the full article click HERE...

Ojai Valley Brewery Making Beer Local

By Sarah Howery Hart

To read the full article click HERE

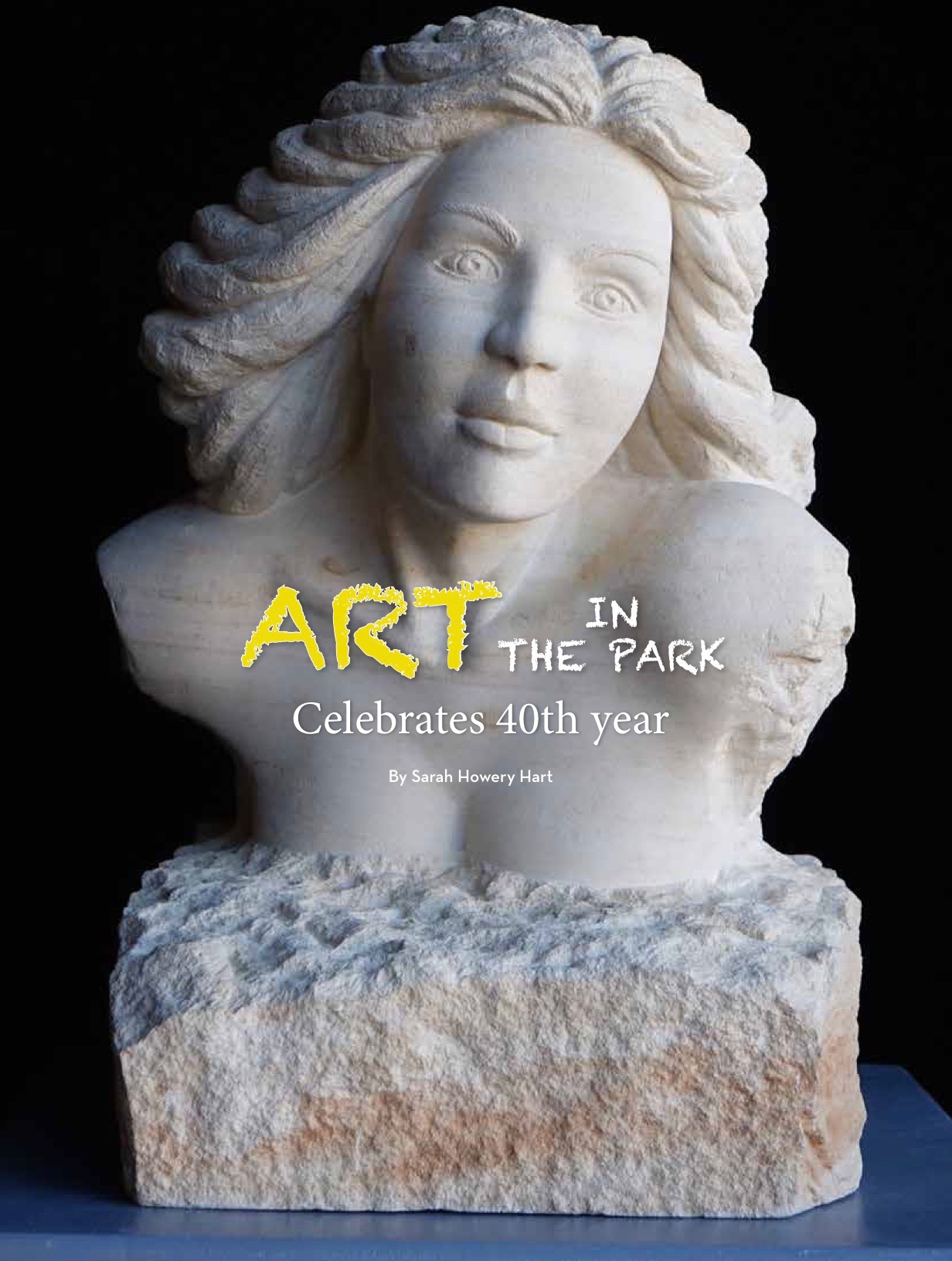

Art in the Park

By Sarah Howery Hart

To read the full article click Here...

Homes Sold in Ojai in April

To read the full article, click HERE...

Hackers are after your Downpayment

To read this article click HERE...

How Home Appraisals Work

To read this article click HERE

7 mistakes that that cost home owners big money during cold water

Click Here to read more...

The lowdown of the downpayment Click HERE

Ojai Music Festival

You do not want to miss the next Ojai Music Festival. Read more...

805.207.5094

Stay Informed

Hi, I'm Ross and I'd love to send you my monthly Newsletter:

"The Ojai Informer"

absolutely FREE.

It will keep you up to date with the latest happenings and tell you about great deals on cool stuff.

Just enter your information below and you'll start receiving them with the very next issue.

Enjoy!